Personal Finance Portal (PFP) & Open Banking (Nov 2020)

Open Banking is now available through your Personal Finance Portal (PFP). Open Banking is a new way to link your bank accounts to the PFP.

Open Banking is the consumer-friendly face of a new law that requires UK banks to provide secure access to your data via an interface called API.

PSD2, which is the name of the law, was introduced to make it easier for bank customers to access their data not just by using the banks' online functions but also tools such as Personal Finance Portal (PFP).

This new service links directly your bank accounts without the need to share any of their banking log in details. Clients who use PFP will be able to link their current and savings accounts and credit cards, providing them with a more detailed view of their income and expenditure on the portal.

Open Banking is fully regulated by the FCA and our service provider Intelliflo is now an FCA Registered Account Information Service Provider (RAISP).

Linking accounts to PFP is quick, secure and done via the account providers own platform, providing an authentication journey the user will be familiar with and trust.

When connecting your bank to PFP via these APIs you do so in a secure way by not sharing any online bank credentials with us or anyone else. PFP will get access to your account(s) for 90 days after which our access token will expire, and you can choose to re-authenticate (we will send a gentle reminder) or refuse us access.

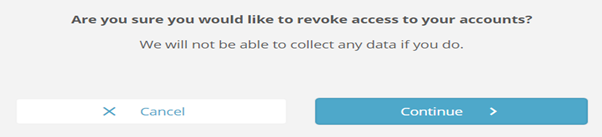

Sharing of account and transaction data with PFP is completely voluntary, and you are always in charge of what to share with us. You can always revoke your consent whenever you like either from within PFP or via your online bank’s dedicated page for this.

How to link bank accounts to PFP?

Log into your PFP account (you may have to register first), go to Menu and Linked Accounts and click on Link New Account.

What are the benefits to you?

You get to see all of your finances in one place. Open Banking currently supports current accounts, credit card accounts and some savings accounts.

- Account balances and new transactions are automatically updated to PFP every day

- Transactions are automatically categorized so you can see a detailed view of how and where you spend your money

- Graphs, filters and search functions allow you to analyse your spending patterns over different timeframes

- You can recategorize transactions singly or in groups to improve and personalise your data - our categorization engine also learns from recategorized transactions to improve accuracy

- You can set PFP Insights to notify you of the categories you spend most in weekly and also when large transactions pass through your accounts

- You can also set monthly budgets for spending in categories and track their progress against those budgets

Open Banking means you authenticate directly with your provider on screens, which are familiar to you from your online banking – there’s no sharing of passwords or security information.

What are the benefits to us?

- Open Banking data helps us to Know Your Client and encourages more collaboration with you

- Open Banking will provide us with accurate data, which will improve and streamline our fact find. Soon you will be able to use your transaction history to populate the income and expenditure section of the fact find. This means that we will get an incredibly accurate view of your incomings and outgoings – no more needing to go through bank statements trying to work those numbers out. We're turning on this feature in around 4-6 weeks to allow optimization of the categorization engine, which will become more accurate as more clients recategorize transactions

- A better understanding of current incomings and outgoings means a more realistic idea of future income needs and therefore future pension needs

- Your account balances are updated daily so information is always up-to-date and we can see if a client’s financial position changes

Which providers are supported at launch?

Open Banking is still new and many providers are still developing the API connectivity they need to be part of the ecosystem.

We have initially integrated with the FCA's 'CMA9' who are the 9 largest UK banking providers according to the Competition and Markets Authority.

Including the sub-brands of these providers that gives an initial supported list of the following: Barclays Bank (Personal, Business, Wealth and Barclaycard), Lloyds Bank, Bank of Scotland, MBNA and Halifax, HSBC, First Direct and M&S Bank, RBS, NatWest and Ulster Bank, Nationwide, Santander, AIB Group UK and First Trust, Bank of Ireland (UK).

Which providers will be added next?

TSB, Tesco Bank, Metro Bank, American Express, Clydesdale Bank.

What about accounts not covered by Open Banking?

Whilst some providers outside of the largest 9 have already made their payment accounts available through Open Banking, others are still in development.

Most non-payment accounts (including those provided by the largest providers) are also not available through Open Banking.

Does Open Banking support joint accounts?

Open Banking does not fully support joint accounts yet. You should be aware that any accounts which you link to your PFP will be treated as personal accounts. Therefore, if partners both have a PFP account and both use Open Banking to link a joint account, and your PFP settings are configured such that they can view each other's plans, then the joint account would be duplicated in that scenario. We are currently looking at a solution whereby a client could indicate who they share a joint account within the absence of a solution provided by Open Banking.

Which accounts are covered by Open Banking?

The FCA mandated that the UK's largest 9 banking providers initially needed to make their payment accounts available through Open Banking (current account and credit cards) Other providers are expected to make their payment accounts available through Open Banking throughout 2020 and beyond. Some savings accounts are supported, where the provider deems those accounts to be “payment accounts”, but this varies by provider. Each of you will know which accounts are available to link as your provider will allow you to select from a list of their available accounts.

Which clients have access to Open Banking via PFP?

Open Banking is open to ALL clients that use PFP, it is up to you to decide if you want to use it or not.

Can I delete my account(s) if I no longer want to use Open Banking?

Yes, you have full control and you can revoke access as and when you want to, this is completed in your PFP account > Menu > Linked Accounts > Click on the bin icon.

Will my account be there for all time and just continue to update?

No, the accounts will need to be refreshed every 90 days by you, you will get a gentle reminder as and when this is required but while they are live the accounts will update daily.

Will we be able to see all the account details including all the client’s transactions?

We will be able to see the name of the account (clearly labelled as Open Banking) and the current value. Only you will be able to see your transactions.